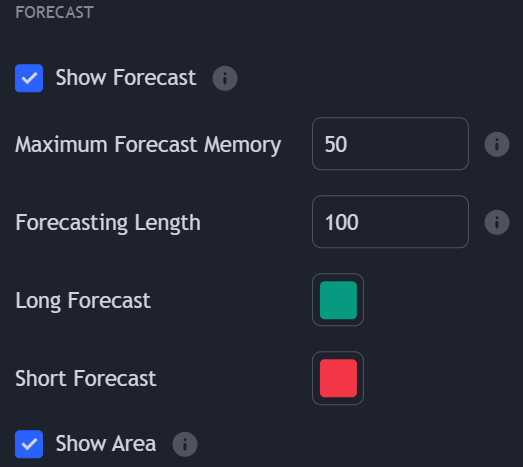

Using Forecasts

Because of the forecasting algorithm used, forecasts can have a lower length than the one selected by the user depending on the average bars in trade.Very frequent trades will generally return short price forecasts due to the lack of available data.

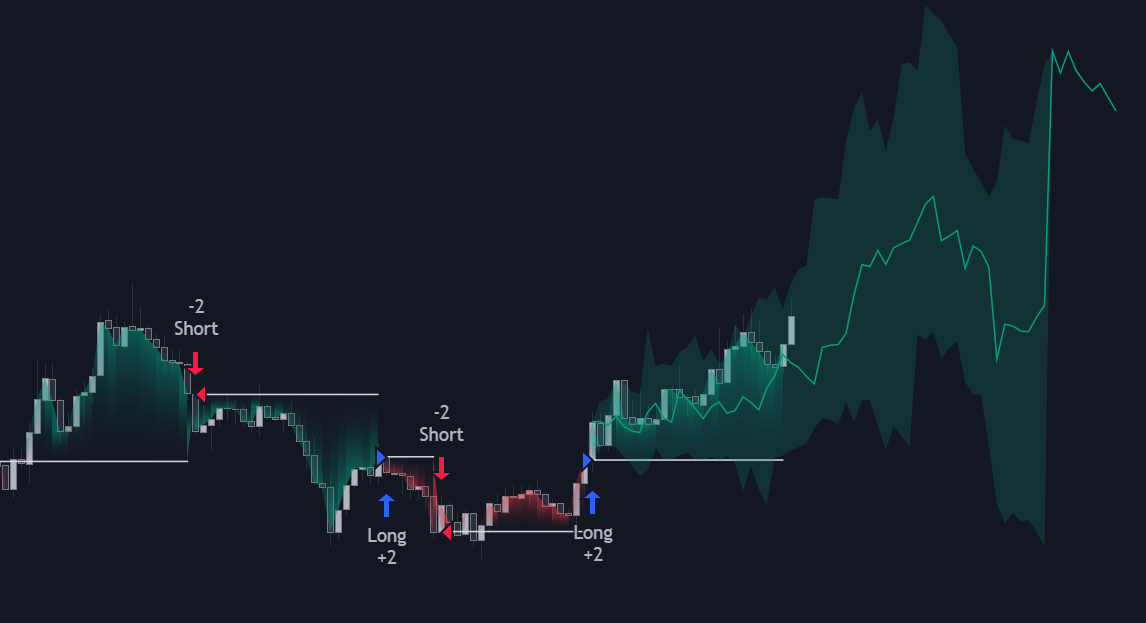

Forecasting Area

- For long positions: A lower extremity not significantly going below the entry price can indicate good past performance for long positions.

- For short positions: An upper extremity not significantly going above the entry price can indicate good past performance for short positions.

If an area is no longer visible in a point in time of the forecast it means that there is not enough data for that point in time.

Forecasting Memory

Users can control the influence older trades have on the forecast using the “Maximum Forecast Memory” setting, with lower values using a shorter term memory, discarding older information more quickly. Low values of this setting allow obtaining more diverse forecasts for new trades, while higher values will return forecasts less subject to change over time.Take Profits Levels From Forecast

When forecasts are displayed, users can set take profits using the nth percentile of a returned forecast. This can be done from the “TPS & SLS” settings, by selecting “Forecast” in the “Long TP” and/or “Short TP”. The numerical setting selected at the right of the drop-down menus determines the percentile used, and should be set within the range [0, 100] in order to work. Percentiles values can affect the returned levels as follows:- In case of a long trade, a lower set percentile will return take profits closer to the entry price, potentially triggering sooner.

- In case of a short trade, a lower set percentile will return take profits further away from the entry price, potentially triggering later.