Strategies Configuration

Strategies are evaluated using a maximum of the most recent 20.000 bars, with an initial capital of 10.000 base currency, without commissions/slippage, and using default settings for all toolkits features. Unit position sizing is used across all tickers. When a strategy enters a trade, any previous trade is closed. As such, it is not possible for two positions to be open at the same time.Strategies do not make use of stop losses or take profits.

Schedule

In order to preserve ressources and avoid redundancy we run backtests three times a week:- Monday 23:30 UTC

- Wednesday 23:30 UTC

- Friday 23:30 UTC

Supported Tickers

The following tickers are supported:Stocks (Cboe BZX)

Stocks (Cboe BZX)

- AAPL

- AMD

- AMZN

- BABA

- CELH

- COIN

- CRWD

- DIS

- DUOL

- GME

- GOOG

- HOOD

- INTC

- MA

- META

- MSFT

- MSTR

- NFLX

- NKE

- NVDA

- ORCL

- PLTR

- PYPL

- RIVN

- SMCI

- SNOW

- SOFI

- TSLA

- UBER

- WMT

ETFs (Cboe BZX)

ETFs (Cboe BZX)

- ARKK

- IWM

- QQQ

- SPY

- VTI

Crypto

Crypto

- AAVEUSDT (Binance)

- ADAUSDT (Binance)

- ATOMUSDT (Binance)

- AVAXUSDT (Binance)

- BCHUSDT (Binance)

- BNBUSDT (Binance)

- BTCUSDT (Binance)

- DOGEUSDT (Binance)

- DOTUSDT (Binance)

- EOSUSDT (Binance)

- ETHUSDT (Binance)

- HBARUSDT (Binance)

- HYPEUSD (Kucoin)

- JUPUSDT (Binance)

- KASUSD (Kucoin)

- LINKUSDT (Binance)

- LTCUSDT (Binance)

- POLUSDT (Binance)

- SHIBUSDT (Binance)

- SOLUSDT (Binance)

- SUIUSDT (Binance)

- TONUSDT (Binance)

- TRXUSDT (Binance)

- UNIUSDT (Binance)

- VETUSDT (Binance)

- XLMUSDT (Binance)

- XRPUSDT (Binance)

Forex

Forex

- AUDJPY

- AUDUSD

- EURAUD

- EURGBP

- EURUSD

- EURJPY

- GBPAUD

- GBPJPY

- GBPUSD

- NZDUSD

- USDCAD

- USDCHF

- USDJPY

Commodities

Commodities

- XAGUSD

- XAUUSD

- UKOIL

Futures

Futures

- NQ

- ES

- RTY

- YM

- GC

- SI

- CL

- NG

- PL

- ZC

- ZW

- ZS

- 6E

- 6J

US equities (Stocks and ETFs) data is sourced from Cboe BZX and use regular trading hours.Futures are based on continuous contracts and use electronic trading hours, without adjustment for contracts changes. Additionally, unlike TradingView, Futures contracts roll on the day prior to expiration.

Supported Timeframes

5m, 15m, and 60m timeframes are supported.Strategy Entry and Exits Constructions

Strategy entry conditions can make use of multiple conditions from different toolkits together. We classify conditions as triggers and filters:- Triggers: Triggers determine the initial conditions used by a strategy. These tend to be less persistent events on a chart, occurring for a single bar.

- Filters: Filters add precision to a strategy, potentially filtering out bad trades that would have been taken by simply using triggers. Filters tend to be more persistent, lasting for multiple bars on a chart.

It is possible for a long/short entry condition to contain both bullish and bearish conditions

Finally, it is possible that some strategies using conditions from the Signals & Overlays® toolkit use exits condition to close trades.

- long: Confirmation Any Bullish and Bullish Smart Trail and Bearish Trend Tracer

- short: Confirmation Any Bearish and Bearish Smart Trail and Bullish Trend Tracer

Signals & Overlays® Conditions

Triggers

Bullish Triggers

Bullish Triggers

- Confirmation Any Bullish

- Confirmation Normal Bullish

- Confirmation Strong Bullish

- Contrarian Any Bullish

- Contrarian Normal Bullish

- Contrarian Strong Bullish

- Smart Trail Switch Bullish

- Price Cross Under Reversal Zones S1

- Trend Tracer Switch Bullish

- Trend Catcher Switch Bullish

- Neo Cloud Switch Bullish

Bearish Triggers

Bearish Triggers

- Confirmation Any Bearish

- Confirmation Normal Bearish

- Confirmation Strong Bearish

- Contrarian Any Bearish

- Contrarian Normal Bearish

- Contrarian Strong Bearish

- Smart Trail Switch Bearish

- Price Cross Over Reversal Zones R1

- Trend Tracer Switch Bearish

- Trend Catcher Switch Bearish

- Neo Cloud Switch Bearish

Filters

Bullish Filters

Bullish Filters

- Confirmation Uptrend

- Contrarian Uptrend

- Bullish Smart Trail

- Price Below Reversal Zones S1

- Trend Tracer Bullish

- Trend Catcher Bullish

- Neo Cloud Bullish

Bearish Filters

Bearish Filters

- Confirmation Downtrend

- Contrarian Downtrend

- Bearish Smart Trail

- Price Above Reversal Zones R1

- Trend Tracer Bearish

- Trend Catcher Bearish

- Neo Cloud Bearish

Neutral Filters

Neutral Filters

- Trend Strength Trending

- Trend Strength Ranging

Exits

Strategies using the Signals & Overlays® toolkit can make exit trades which are outlined below:Exit Conditions

Exit Conditions

- Any strategy using Confirmation Signals can make use of builtin-exits labelled as “Confirmation Built-in Exits”.

- Any strategy using Contrarian Signals can make use of builtin-exits labelled as “Contrarian Builtin Exits”.

- Any strategy using Reversal Zones can make use of the exit condition “Price Cross R1/S1 Average”, which will exit a trade when price crosses the average of the Reversal Zones.

Price Action Concepts® Conditions

Currently only triggers are supported for the Price Action Concepts® toolkit.

Triggers

Bullish Triggers

Bullish Triggers

- Bullish CHoCH

- Bullish BOS

- Bullish OB Entered

- Bullish OB Exited

- New Bullish FVG

- Bearish FVG Mitigated

- New Bullish Opening Gap

- Bearish Opening Gap Mitigated

- New Bullish Volume Imbalance

- Bearish Volume Imbalance Mitigated

- Bullish Liquidity Grab

- Bearish Trendline Break

Bearish Triggers

Bearish Triggers

- Bearish CHoCH

- Bearish BOS

- Bearish OB Entered

- Bearish OB Exited

- New Bearish FVG

- Bullish FVG Mitigated

- New Bearish Opening Gap

- Bullish Opening Gap Mitigated

- New Bearish Volume Imbalance

- Bullish Volume Imbalance Mitigated

- Bearish Liquidity Grab

- Bullish Trendline Break

Oscillator Matrix® Conditions

Triggers

Bullish Triggers

Bullish Triggers

- New Bullish Overflow

- Money Flow Crossing Over 50

- HyperWave Oversold Bullish Signal

- HyperWave Crossing Over 80

- HyperWave Crossing Over 50

- Reversal Any Up

- New HyperWave Bullish Divergences

Bearish Triggers

Bearish Triggers

- New Bearish Overflow

- Money Flow Crossing Under 50

- HyperWave Overbought Bearish Signal

- HyperWave Crossing Under 20

- HyperWave Crossing Under 50

- Reversal Any Down

- New HyperWave Bearish Divergences

Filters

Bullish Filters

Bullish Filters

- Bullish Overflow

- Money Flow Above 50

- HyperWave Above 80

- HyperWave Above 50

- Strong Bullish Confluence

- Weak Bullish Confluence

Bearish Filters

Bearish Filters

- Bearish Overflow

- Money Flow Below 50

- HyperWave Below 20

- HyperWave Below 50

- Strong Bearish Confluence

- Weak Bearish Confluence

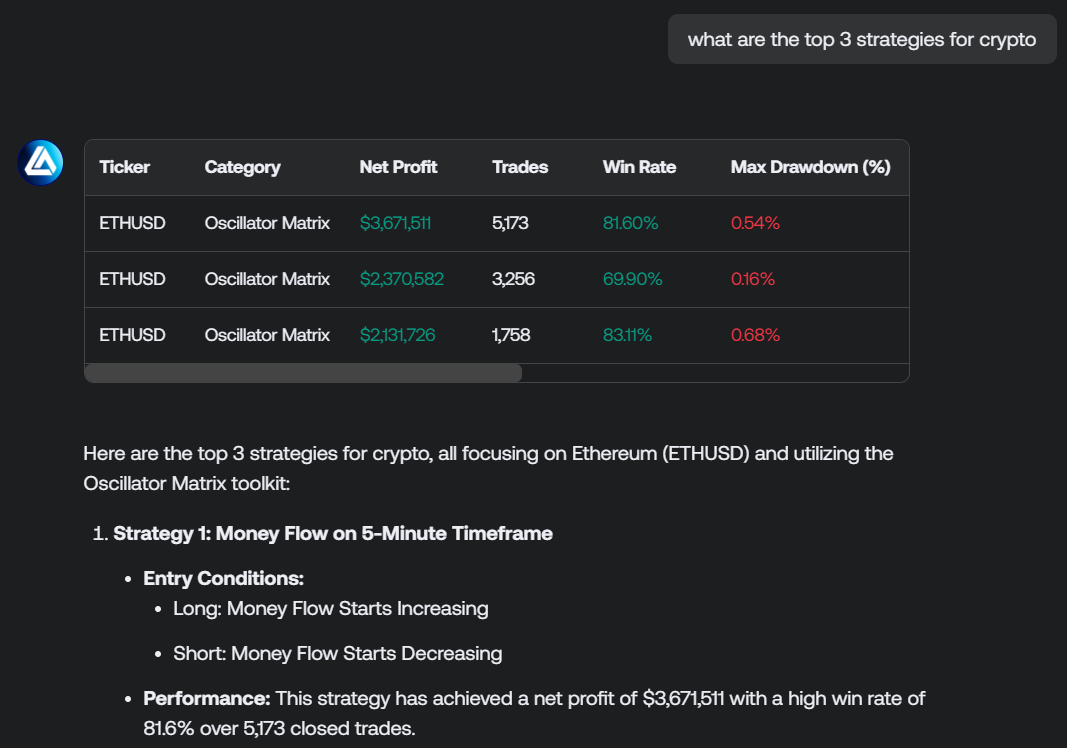

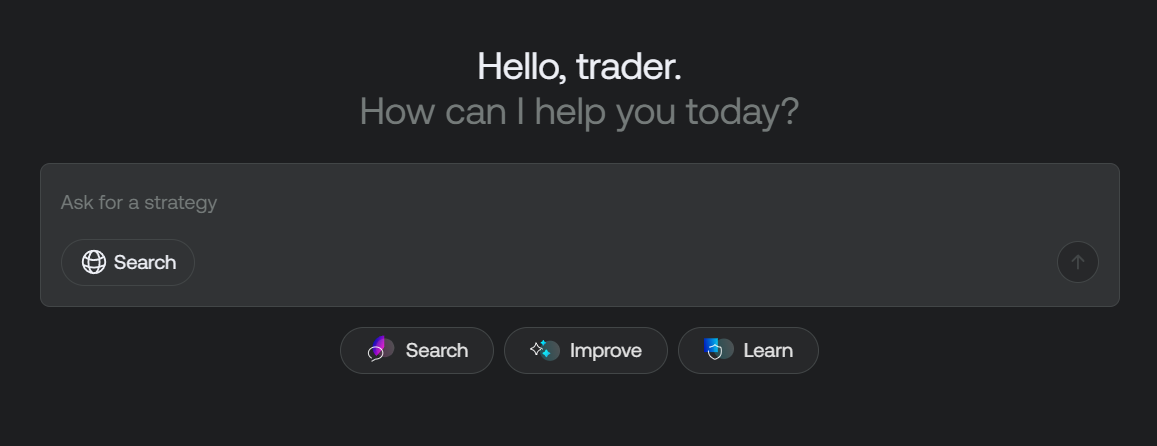

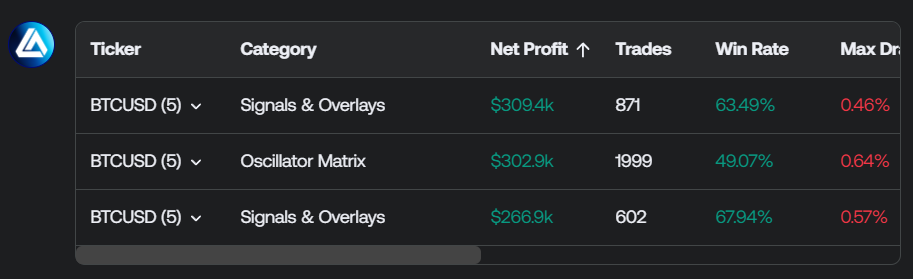

How To Fetch Strategies

- What is the best performing strategy across all crypto tickers on the 5-minute timeframe?

- Give me three strategies using fair value gaps that have a winrate above 80%.

- Find a strategy with above average net profit but below average drawdown.

- Net Profit

- Max Net Profit

- Closed Trades

- Winning Trades

- Losing Trades

- Winrate

- Gross Profit

- Gross Loss

- Profit Factor

- Max Drawdown

- Max Drawdown Percent

- Average Trade

- Average Winning Trade

- Average Losing Trade

Due to calculations being sensitive to data differences, our Drawdowns calculations are based on realized profits/losses, which is not the case on TradingView, this can explain why certain differences can be observed.

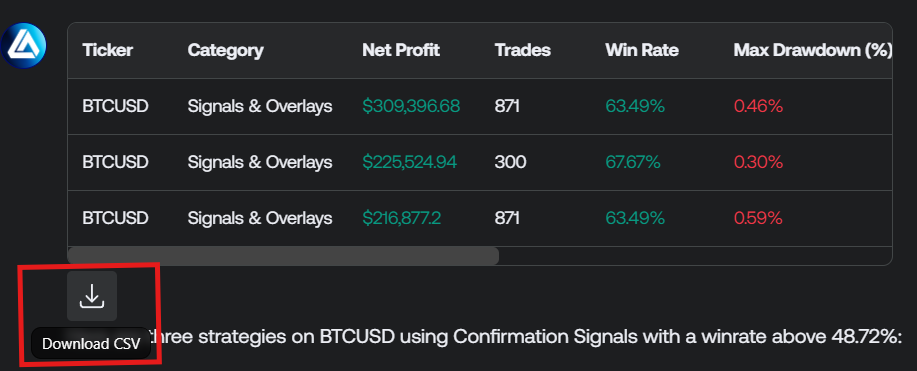

A maximum of 3 strategies can be returned in a table at once, while a maximum of three strategies can be returned from a single fetching operation.If the AI needs to fetch more than 3 strategies it will fetch strategies sequentially.

- Strategy begins at: When the strategy started being evaluated

- Strategy current position: Long, short, or flat if no positions are currently open

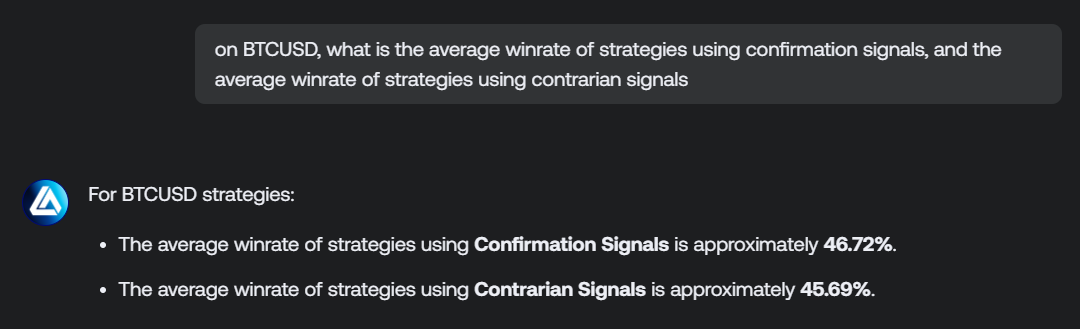

Fetch Statistics Across The Entire Strategy Population

- What is the total net profit of all bitcoin strategies you have?

- On BTCUSD, are strategies using normal Confirmation signals better than the ones using strong Confirmation signals overall?

- What is total net profit of profitable strategies across stocks?

Do note that such prompts can lead to high wait time for the results.

Analyzing strategy trades

A returned strategy by the AI Backtesting Assistant contains a list of trades, each having information on its side (long / short), entry time and price, closing time and price, and P&L result. The AI Backtesting Assistant may filter trades by their index, trade side, result (win / loss), holding time (in minutes), P&L, opening and closing time. Then an operation may be applied to a specific trade information from the filtered results. Available capabilities from the trade analysis include:- Trade filtering by index, trade side, result (win / loss), holding time (in minutes), P&L, opening and closing time

- Operations on filtered subset such as average, median, count, sum, percentage

- Winning/Losing streak analysis

- Which trade has been the most/least profitable one?

- What is the entry and exit price price of most profitable long trade?

- What is the average trade duration of winning trades?

- What is the average profit/loss of trades with a duration above 50 minutes?

- How many winning trades occurred after 14 Jan 2025?

- What is the percentage of trades amongst the first 50 ones that are winning trades?

- What is the losing streak length before the last win?

- What is the average winning streak length?

- How many trades have a profit superior to the average winning trade?

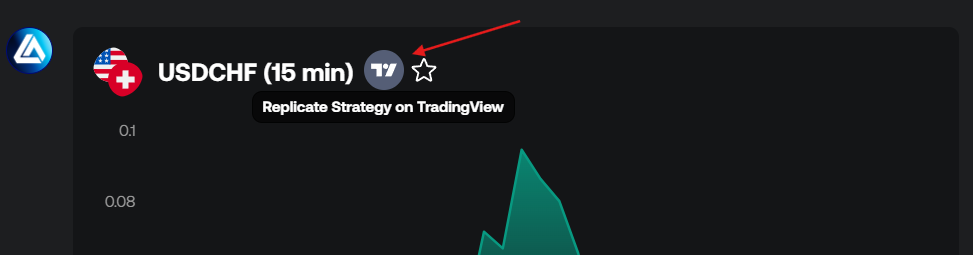

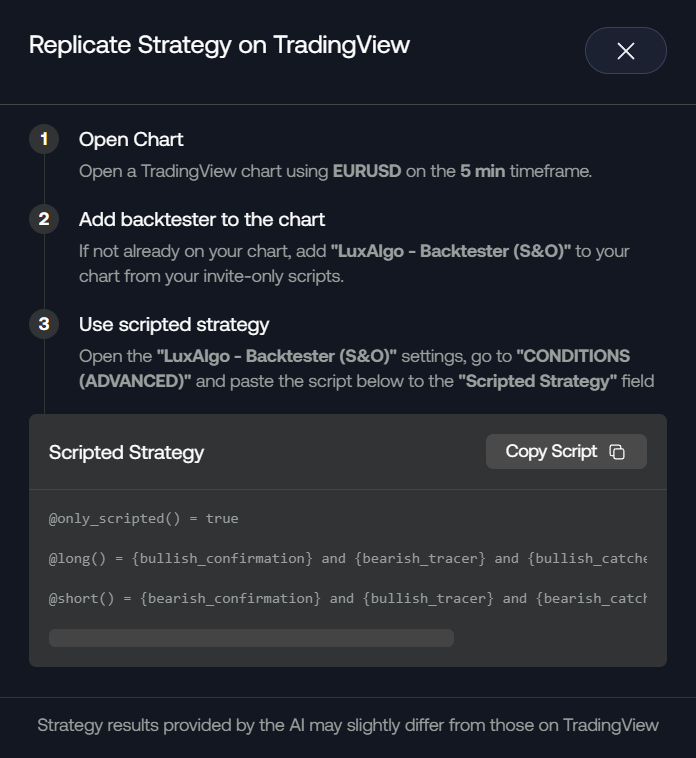

Reproducing a Strategy on TradingView

Once you get a strategy you like, you may be inclined to add it to your chart to visualize it and further optimize its results on TradingView.

A strategy using multiple conditions from at least two toolkits will require using LUCID connectors, learn more about LUCID connectors here.

Saving Strategies

Prompting Tips

The AI can make mistakes when fetching strategies, as this is a very complex process depending on the user query. We will always aim to improve the AI Backtesting Assistant over time; however, the following tips can help you get the most from our AI.Make Detailed Queries

Make sure to detail every aspect of the strategy you want to fetch if you have a precise one in mind, for example:| Original | Improved |

|---|---|

| Fetch a strategy that uses Confirmation Signals | Fetch a strategy that only uses Confirmation Signals and no other conditions |

| I want a PAC strategy that goes long on a new FVG, and CHoCH | I want a PAC strategy that goes long when: - Step 1: a new bullish FVG occur - Step 2: a bullish CHoCH occur |

| I want the best strategy | I want the strategy with the highest net profit on BTCUSD 5 minute |

Encourage the AI to Improve

The AI Backtesting Assistant can be fairly self-aware if a fetched strategy doesn’t meet a user criteria, and will then retry. But if the AI response is clearly mistaken, then it can be good to let it know using a prompt encouraging re-evaluation of the fetching process:The strategy your returned is not the one I want. Correct the issue in your fetching process and retry to fetch the strategy in accordance with my query.

Split Complex Queries Into Multiple Tasks

The AI will be more prone to mistakes if the query is complex, as such, it is best to do follow-up messages asking about the details of a strategy rather than asking the AI to give those alongside other information. For example:Return a good strategy on BTCUSD, alongside the average net profit of all strategies on BTCUSD that use Confirmation signals, then tell me what the highest winrate strategy is, using the same conditions as the first oneThe AI Backtesting Assistant might provide more relevant answers if we let context accumulate by splitting and re-ordering our initial query into multiple ones: