Price Action Conditions

| Condition | Description |

|---|---|

| CHoCH or BOS | Triggered on a change of character or break of structure |

| CHoCH | Triggered on a change of character |

| BOS | Triggered on a break of structure |

| OB Mitigated | Triggered once price mitigates an order block |

| OB Within | Triggered if price is within the area of an order block |

| OB Entered | Triggered once price enters the area of an order block |

| OB Exited | Triggered once price exits the area of an order block |

| Imbalance Entered | Triggered once price enters the area of an imbalance |

| Imbalance Within | Triggered if price is within the area of an imbalance |

| Imbalance Mitigated | Triggered once price mitigates an imbalance |

| Imbalance Exited | Triggered once price exits an imbalance |

| Liquidity Grab | Triggered once a liquidity grab is detected |

| Trendline Break | Triggered once a trendline is broken. Note that a bullish trendlinereffers to an uptrending trendline, while Bearish reffers to a downtrending trendline. |

User can change the settings of each price action concept by scrolling down the settings, each concept has its own setting group. To learn more about each concept see:Market StructuresOrder BlocksImbalancesLiquidity Grabs

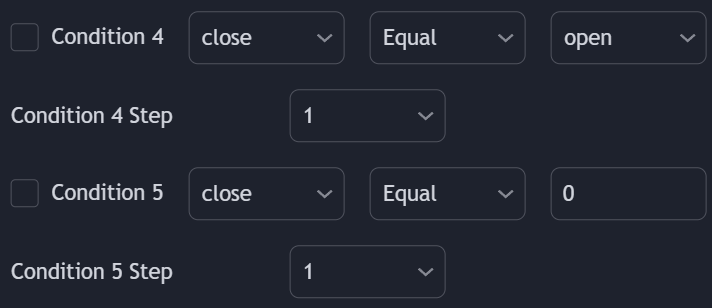

External Conditions

- Greater Than

- Lower Than

- Equal

- Crossing Over

- Crossing Under

- Crossing

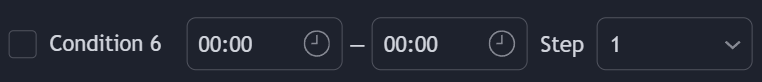

Session Condition

Session timezone is the same as the one of the chart symbol exchange (UTC for cryptocurrencies)

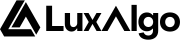

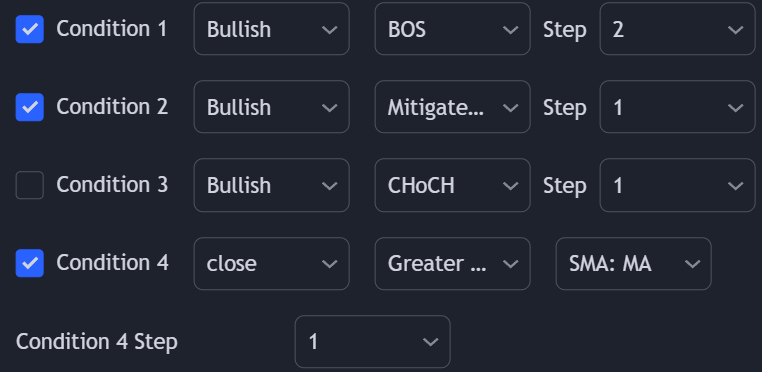

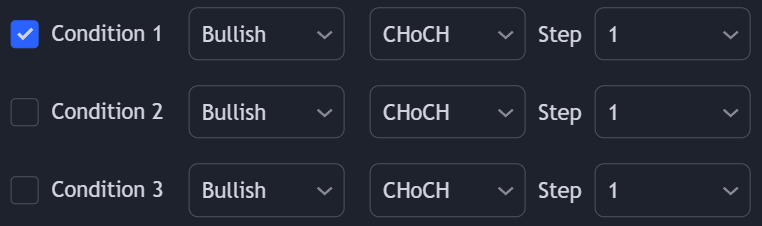

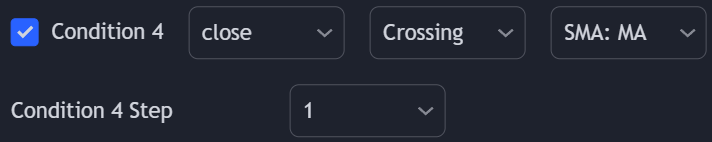

Using Conditions Together

More complex entry rules can be created by using multiple conditions together, this is done thanks to the Step dropdown setting on the right of each condition (below each condition for conditions 4 and 5). The Step setting is directly related to the Step & Match algorithm and work in two ways:- When two or more conditions have the same step number, both conditions are evaluated. Used to test matching conditions.

- When two or more conditions have different step numbers, each conditions will be evaluated in order, testing for the first step and switching to the next step once the previous one is true. When the final step is true the strategy will open a market order. Used to create sequence of conditions.

Invalidate Step

The “Invalidate” step allows to set a condition as an “invalidation condition”. When this condition is triggered while a sequence of conditions is incomplete, the sequence will restart at step 1. If multiple steps are set as “Invalidate” any of the conditions being true will reset the sequence of conditions, as such not all of them are required to be true for the sequence of conditions to reset.Example

Let’s take an example where we use 2 regular steps and one “Invalidate” step. The position will be opened when step 2 trigger after step 1 has been triggered.

1

Step 1

Step 1 condition trigger, we will now evaluate step 2 from now on.

2

Invalidation Step

Invalidation step condition trigger, we reset the sequence and evaluate step 1 just after.

Invalidation Behaviors

Invalidation behaviors allows adding more restrictions to a sequence of conditions, users can use two different invalidation behaviors described below:Invalidate On Step 1

The “Invalidate On Step 1” behavior allows to reset an incomplete sequence of conditions when the condition on step 1 trigger. This prevents the first step condition from happening in between other steps of the condition sequence. This behavior is useful when the first step of our sequence of conditions needs to never be repeated during the sequence.Example

Let’s take an example where we use 3 regular steps.

1

Step 1

Step 1 condition trigger, we will now evaluate step 2 from now on.

2

Step 2

Step 2 condition trigger, we will now evaluate step 3 from now on.

3

Step 1 Trigger

Step 1 condition trigger, we start evaluating step 2 from now.

Invalidate On Any Repeated Step

The “Invalidate On Any Repeated Step” behavior allows to reset an incomplete sequence of conditions when a step is triggered such that it does not respect the set order of conditions. This behavior is useful when we want a perfectly ordered sequence of conditions to complete, without any step repeating itself.Example

Let’s take an example where we use 3 regular steps.

1

Step 1

Step 1 condition trigger, we will now evaluate step 2 from now on.

2

Step 2

Step 2 condition trigger, we will now evaluate step 3 from now on.

3

Step 1 or 2 Trigger

Step 1 or 2 conditions trigger, we start evaluating step 1 from now.

No Existing Positions Requirement

Users can enable the Don’t Allow Trades Until Closed setting in order to only open trade when no existing positions are open. This setting allows waiting for a position to be closed before one can be opened.Enabling Don’t Allow Trades Until Closed for long positions will prevent opening shorts as long as a long position is opened.If this same setting is not enabled for short conditions then shorts can effectively be closed by new long positions.