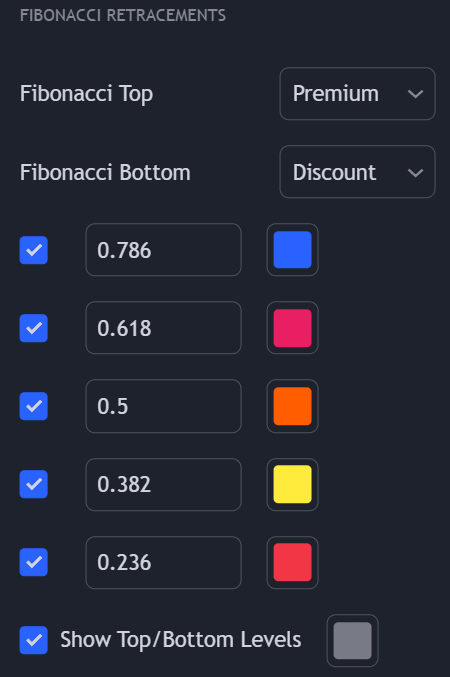

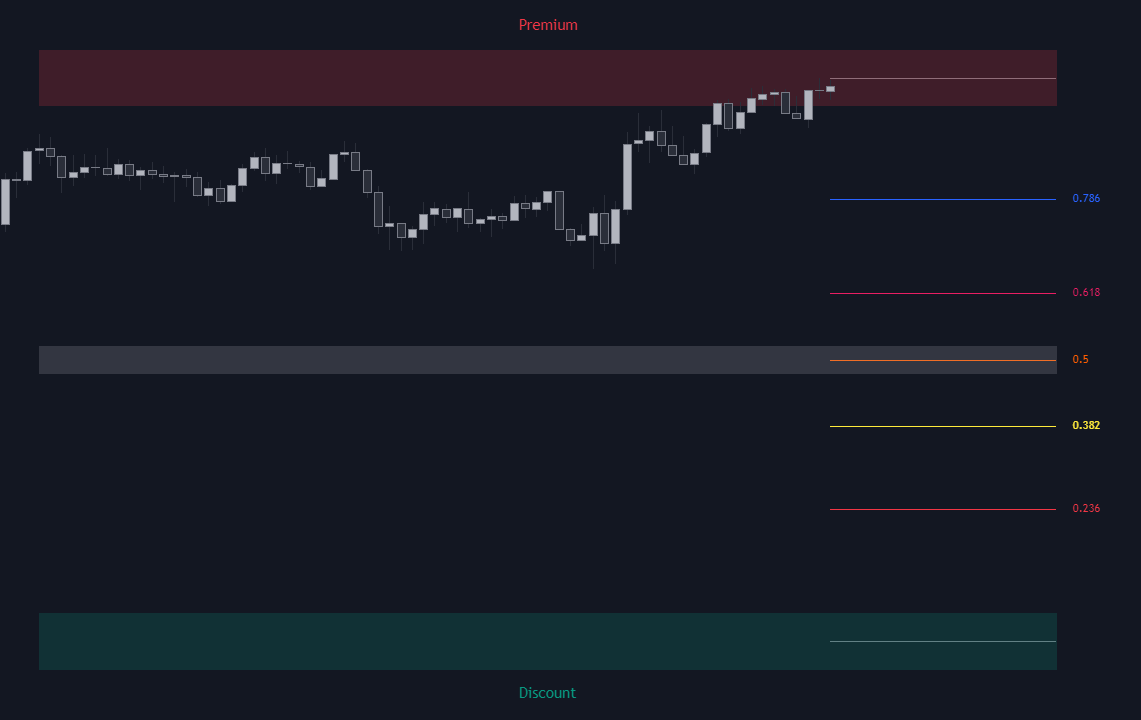

Possible Extremities

The upper/lower extremities used to construct the Fibonacci retracements can be selected from the “Fibonacci Top” or “Fibonacci Bottom” dropdown settings, and can be obtained from the following features within the Price Action Concepts® toolkit:Swing Points

Swing Points

- Internal High

- Internal Low

- Swing High

- Swing Low

Premium/Discount

Premium/Discount

CHoCH/BOS

CHoCH/BOS

- Bullish I-CHoCH

- Bearish I-CHoCH

- Bullish I-BOS

- Bearish I-BOS

Orderblock

Orderblock

- Highest OB Top

- Lowest OB Bottom

Imbalance

Imbalance

- Imbalance Top

- Imbalance Bottom

- Imbalance Average

Previous H/L

Previous H/L

- Previous Day High

- Previous Day Low

- Previous Week High

- Previous Week Low

- Previous Month High

- Previous Month Low

- Previous Quarterly High

- Previous Quarterly Low

Ratios

Anchor To Origin

| Extremity | Anchor |

|---|---|

| Swing High | Swing High Location |

| Swing Low | Swing Low Location |

| Internal High | Internal High Location |

| Internal Low | Internal Low Location |

| Premium / Equilibrium Average / Discount | Oldest anchor between Swing High and Swing Low Locations |

Only the above extremities are compatible with “Anchor To Origin”.